Page 30 of 71

The Republican Party

Posted: Sat Dec 16, 2017 8:37 am

by Vince

Well, I'm not overly worked up about the tax cuts that expire in 7 or 8 years. Pretty sure those will be fixed before then so the people in office at that time don't get tossed on their asses. Again, that's an accounting trick since they have to budget these out for 10 years for scoring.

It looks like the final form has limited refundablitity to $1400. I'm okay with that. I've never really had a problem per se with people getting the child income credits beyond what they put in, but I have always had a problem with that check coming from the treasury rather than HHS. It's welfare. I'd rather they treat it as such. The standard deduction has been about doubled. Personal exemptions are eliminated, but I don't know how many poor people itemize. I would suspect this would have a minimal impact on the poor. All-in-all I don't see a lot to really scream about. Other than the debt. But I'm never sure how accurate those numbers are anyway. They are usually way off. Granted, they usually low ball how much this stuff will cost but the OBM has seemed to be really politicized lately. They changed their methodology after the health care debate, just in time for the tax reform debate. I've heard that this new methodology would have helped the Republican health care bill, but hurts the tax reform bill. So I don't know.

I have heard that this bill is kind of sloppy and the rich in some areas (high real estate values and local taxes) could reach a point where after a point they are paying $115 for every $100 earned.

More and more I just feel like everyone is lying to us.

The Republican Party

Posted: Sat Dec 16, 2017 9:55 am

by Vince

The Republican Party

Posted: Sat Dec 16, 2017 11:13 am

by Vince

The Republican Party

Posted: Sat Dec 16, 2017 11:21 am

by TheCatt

Needs more details to be accurate. :\

As far as I can tell, my taxes will fall about $6k, mostly due to the pass-through business deduction stuff (20% of my self employment income will no longer be taxed at all)

The Republican Party

Posted: Tue Dec 19, 2017 5:15 pm

by TheCatt

The Republican Party

Posted: Tue Dec 19, 2017 5:16 pm

by TheCatt

If I understand those calculators correctly, it'll be a bigger than expected difference for me.

The Republican Party

Posted: Wed Dec 20, 2017 1:00 pm

by TheCatt

Tax bill is now official.

The Republican Party

Posted: Wed Dec 20, 2017 2:20 pm

by Leisher

Rumored Lauer plaything displays her bias while interviewing Ryan.

I'm not a fan of this tax bill, but where were these questions during Obama's first term when the Dems were spending money like a college kid with their first credit card?

The Republican Party

Posted: Thu Dec 21, 2017 7:40 am

by Vince

I'm between happy and neutral with this tax bill. I think the corporate tax reduction will be really good for the economy. I don't care for deficit spending, but they don't call it "deficit confiscation". The spending is the problem.

The Republican Party

Posted: Thu Dec 21, 2017 9:30 am

by TheCatt

Vince wrote: I'm between happy and neutral with this tax bill. I think the corporate tax reduction will be really good for the economy. I don't care for deficit spending, but they don't call it "deficit confiscation". The spending is the problem.

I still don't love it. The economy is already doing decently. I think this increases our economic volatility as the fed may have to confront increasing inflation. The rich will get much richer, continued inequality, etc.

On the other hand, it probably increases my odds of retiring early.

The Republican Party

Posted: Thu Dec 21, 2017 10:01 am

by Vince

TheCatt wrote:

On the other hand, it probably increases my odds of retiring early.

Don't worry, I still think things will collapse before you get that opportunity

The Republican Party

Posted: Thu Dec 21, 2017 10:08 am

by TheCatt

Vince wrote: TheCatt wrote:

On the other hand, it probably increases my odds of retiring early.

Don't worry, I still think things will collapse before you get that opportunity

Hah! Admittedly, I still need to diversify into bullets + guns.

The Republican Party

Posted: Fri Dec 29, 2017 5:06 pm

by TheCatt

So, I'm one of those people who won't be itemizing next year due to the bill. So I've done a lot of charitable donations in advance of next year, this year. Hope those charities enjoy their $0 next year :\

Also paid extra state taxes this year, and paid my January mortgage payment early to get that interest into this year.

The Republican Party

Posted: Tue Jan 09, 2018 12:34 pm

by Leisher

GOP moron probably commits career suicide.

Listen, I'll argue that what Jimmy the Greek said shouldn't have gotten him fired. Where and when he said it made sense for a firing, but what he said was, like it or not, historic fact.

I know of no historical moment, facts, or even studies that would explain this guy's statement.

The Republican Party

Posted: Tue Jan 09, 2018 1:08 pm

by Leisher

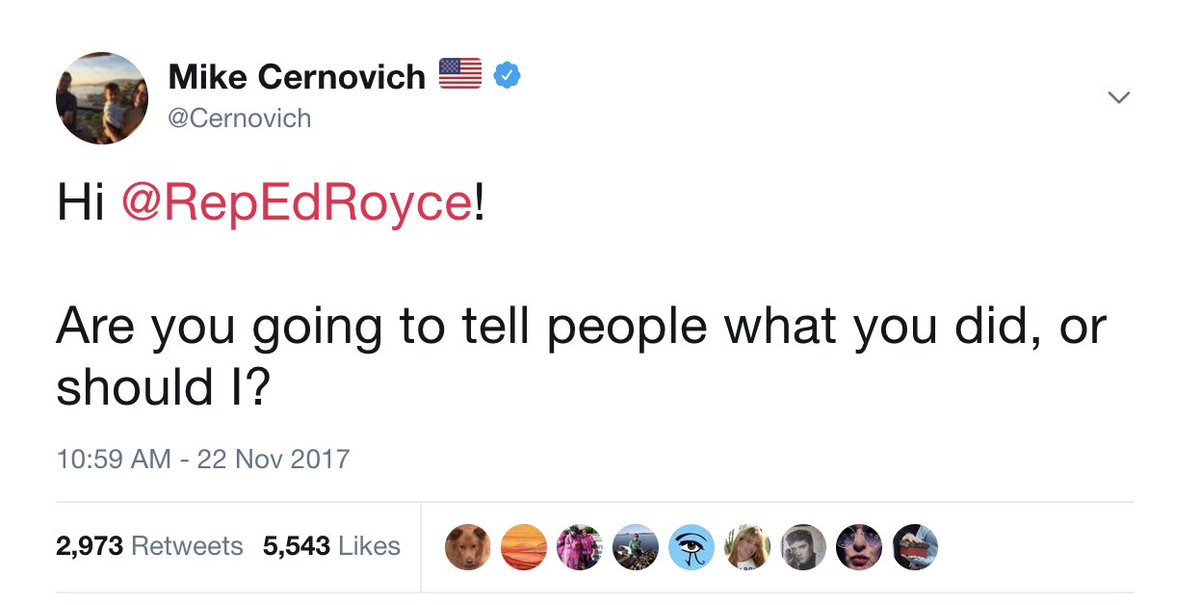

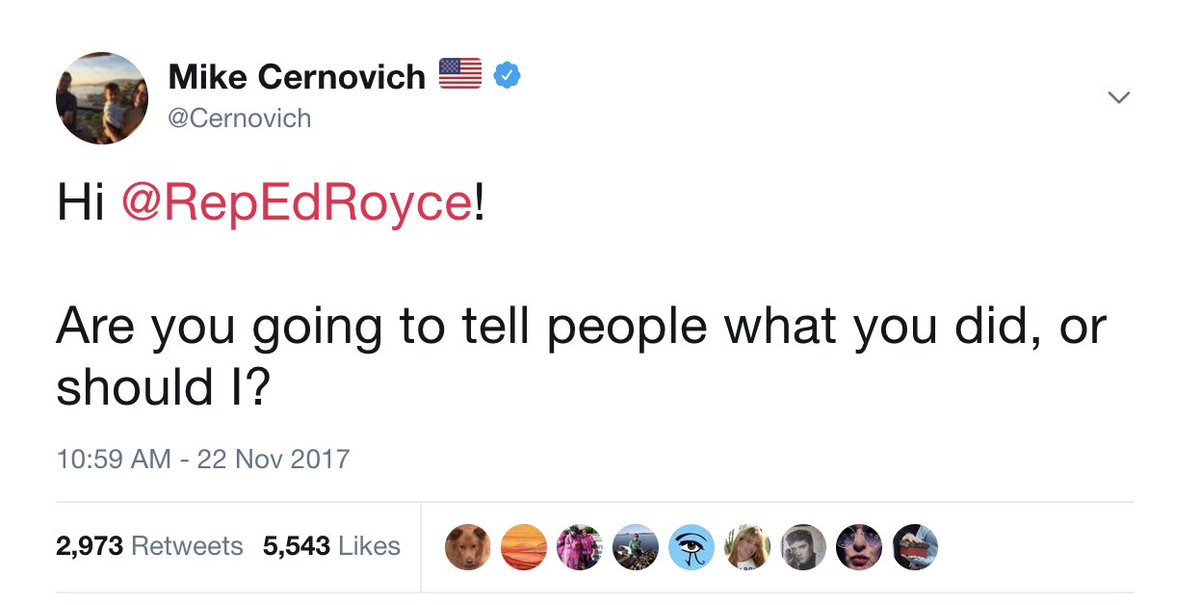

Ed Royce is retiring.

People are wondering if this tweet caused the decision:

The Republican Party

Posted: Tue Jan 09, 2018 1:28 pm

by TheCatt

I can't find any reference to rumours

The Republican Party

Posted: Thu Jan 25, 2018 12:51 pm

by TheCatt

Interesting side effect of the tax changes.

I used to pay a 41.10% marginal tax rate (including state + FICA taxes) on my business income. So if I bought some equipment that I can deduct, boom! 41% off! (Of course, I then have to pay property taxes on it, etc, but that's another story).

My business now pays a tax rate of 28.10%, a drop of 13 points, or 31.7%. Good news overall, but it means that I just a much, much lower write-off for buying stuff, so it makes much less sense to buy stuff. Once the tax reform passed, I bought a bunch of stuff in those last few days of 2017. Hmmm.

The Republican Party

Posted: Thu Jan 25, 2018 9:28 pm

by Leisher

The Republican Party

Posted: Fri Feb 09, 2018 4:29 pm

by Vince

The Republican Party

Posted: Sun Mar 25, 2018 1:36 am

by Leisher